taxing unrealized gains janet yellen

The 78th United States secretary of the treasury Janet Yellen told CNNs State of the Union on Sunday that US. During an interview with CNN on Sunday Yellen touted the idea of taxing the unrealized capital gains of the wealthiest 1.

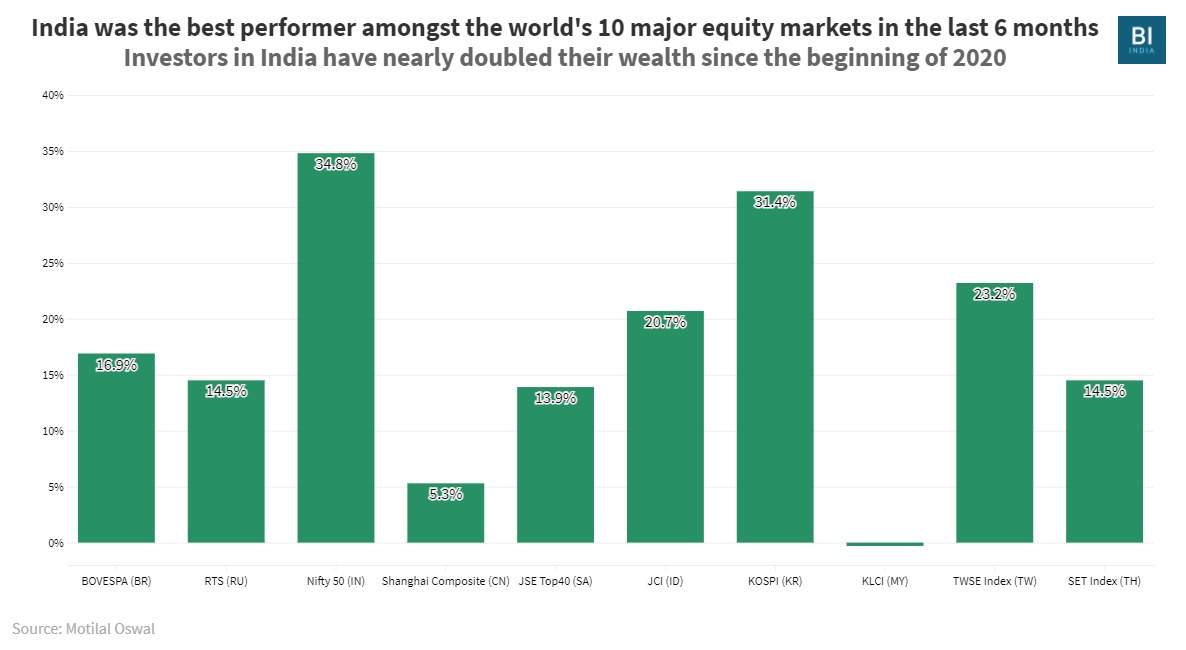

Janet Yellen S Proposal For A Capital Gains Tax In Us May Push Global Money Towards Markets Like India Business Insider India

Its not a wealth tax but a tax on unrealized capital gains of exceptionally wealthy individuals US.

. According to Yellen the funds collected would help finance things. Washington DC provides stiff competition when it comes to stupid ideas related to policy spending and taxation as regular fare but the idea to tax unrealized capital gains is a real doozie. But when Janet Yellens suggestion of taxing unrealized market gains makes its way through Congressional committee Mr.

Capital gains tax is a tax on the profit that investors realize on the sale. The 78th United States secretary of the treasury Janet Yellen told CNNs State of the Union on Sunday that US. The Treasury gig hasnt been.

Meaning that when assets such as stocks crypto and real estate appreciate that value is taxed at the same rate as your income. Heres Janet Yellen talking about taxing unrealized capital gains otherwise known as how to destroy America Oct 25th 2021 231 pm Oct 25th These people want you to own nothing like it and say nothing if the government juggernaut comes. Generally like Yellen but I generally agree with the IRS guiding principle of having the wherewithall to pay - assessing taxes once youve obtained the money to pay for the gains tax - its bold to assume investors will always have the liquidity to pay for unrealized gains.

Idea Of Taxing Unrealized Gains Resurfaces As Money Printing Intensifies. The new Billionaire Income Tax is being written by Senate Finance Committee Chairman Ron Wyden Democrat. The 78th United States secretary of the treasury Janet Yellen told CNNs State of the Union on Sunday that US.

Janet Yellen Bidens nominee for Treasury Secretary reportedly said she would consider taxing unrealized capital gains to boost government revenues. Government coffers during a virtual conference hosted by The New York Times. Its not a wealth tax but a tax on unrealized capital gains of exceptionally wealthy individuals Treasury Secretary Janet Yellen was at pains to explain.

To pay for the 5 trillion love letter to progressives the Democrats have floated taxing unrealized capital gains. Taxing unrealized capital gains also known as mark-to-market taxation What is an unrealized capital gain. Lawmakers are considering taxing unrealized capital gains.

Market just might take exception to that and other approaches to resolving the debt crisis. And this has led some to question if the US is. Treasury Secretary Janet Yellen is currently considering some shocking policies.

Ron Wyden D-Oregon would impose an annual. Lawmakers are considering taxing unrealized capital gains. Treasury Secretary Janet Yellen proposed taxing billionaires unrealized capital gains to fund President Joe Bidens 2 trillion spending bill a bill which the president has claimed costs 0.

It doesnt take a genius to realize how stupid this is and how difficult it would be to actually implement. Lawmakers are considering taxing unrealized capital gains. Bidens newly appointed US.

According to Yellen the funds collected would help finance things related to climate and social change. Yellen Describes How Proposed Billionaire Tax Would Work. Secretary of the Treasury Janet Yellen explaining her taxation proposal Just give me and Joe all your money.

Senator Ron Wyden D Ore was working. United States President Joe Bidens Treasury secretary nominee Janet Yellen has once again become a topic of discussion in the Cryptoverse - this time over her comments suggesting she may look to tax of unrealized gains. Billionaire investor Howard Marks was highly critical of Biden Treasury Secretary nominee Janet Yellen for saying shed consider taxing unrealized capital gains.

24 2021 626 pm ET Original Oct. Secretary Janet Yellen has been discussing in various media the Biden administration is now revealing an unrealized capital gains tax from stocks and bonds. Unrealized capital gains put simply is the increase in the value of an asset that has yet to be sold.

The plan will be included in the Democrats US 2 trillion reconciliation bill. 25 Oct 2021 0. Treasury Secretary Janet Yellen explained on CNN Sunday that the proposal raised by Sen.

Treasury Secretary Janet Yellen told CNN on Sunday. Unrealized Capital Gains Tax In this presentation I will be discussing a proposal brought by Janet Yellen at the department of treasury and our current federal government. Janet Yellen the Treasury Secretary in the Joe Biden administration has proposed taxing unrealised capital gains.

Marks who is co-chairman and co-founder of Oaktree Capital said I think that would hit sentiment. Apparently Janet Yellen has been floating the idea of an unrealized capital gains tax. At a time when there.

While Yellen said that US. 24 2021 125 pm ET. Earlier in 2021 Yellen proposed taxing unrealized capital gains to boost US.

This proposal suggests that we should be taxing unrealized capital gains as income. Janet Yellen the Treasury Secretary in the Joe Biden administration has proposed a tax on unrealised capital gains. Do you think theres a chance this actually happens.

Secretary of the. If so this would be a major hit to anyone who invests and tries to preserve wealth.

Ship Of Fools Biden S Incompetent Economic Team Washington Times

Janet Yellen Favors Higher Company Tax Signals Capital Gains Worth A Look Business Standard News

Janet Yellen S Proposal For A Capital Gains Tax In Us May Push Global Money Towards Markets Like India Business Insider India

Why The Fed Needs Janet Yellen To Steal W Unrealized Capital Gains Avoiding Taxes W Roth Iras Youtube

Democrats Terrible Idea Taxing Profits That Don T Exist

Oaktree Memes Best Collection Of Funny Oaktree Pictures On Ifunny

Bloombergquint On Twitter Yes Taxation Of Unrealised Stock Market Gains Seems Unusual But It Is Already Embedded In The System Argues Shankkaraiyar Calling For A One Time Tax On Billionaires He Points To

Nancy Pelosi Says A Wealth Tax On Billionaires Unrealized Gains Is On The Way Mish Talk Global Economic Trend Analysis

Idea Of Taxing Unrealized Gains Resurfaces As Money Printing Intensifies

Yellen Describes How Proposed Billionaire Tax Would Work Including Yellen S Proposed Tax On Unrealized Gains In The Stock And Real Estate Market R Wallstreetbets

Best Argument Against Unrealized Capital Gains Tax Janet Yellen Capital Gains Tax Youtube

Treasury Secretary Janet Yellen Says Taxing Unrealized Capital Gains Is A Possibility Youtube

Janet Yellen S Proposal For A Capital Gains Tax In Us May Push Global Money Towards Markets Like India Business Insider India

Lesson Of The Day Amy Tarkanian Janet Yellen Just Proposed A Tax On Unrealized Capital Gains

Does Treasury Secretary Yellen Really Want Unrealized Capital Gains To Be Treated As Income Swfi

Biden S Cabinet Janet Yellen Considers Taxing Unrealized Gains R Accounting

Janet Yellen Not Planning A Wealth Tax But Could Do Capital Gains Tax

Janet Yellen S Idea To Tax Unrealized Capital Gains R Wallstreetbets

Janet Yellen Just Proposed A Tax On Unrealized Capital Gains For Those Who Don T Know